| TL;DR What is a sales slump? A sales slump is a sustained drop in a seller’s performance. Sometimes as a direct result of lower activity. Other times, all inputs appear steady while impact quietly declines. How does it show up? Through repeatable patterns: stalled mid-funnel deals, seller-driven next steps, late objections, soft commits, forecast anxiety, and subtle execution delays. How do you catch a sales slump early? By separating volume from quality and watching leading indicators before numbers miss. Slumps begin when weak deals linger and precision slips. How do strong sellers get out of sales slumps? They tighten inputs, return to disciplined execution, and restore buyer trust using tools like Humantic AI instead of pushing harder. |

Salespeople love flexing their wins. When you have a good month, you post revenue screenshots with humble brags like “I crossed 200% of my sales quota.”

What no one posts about are the stretches in between.

The months when you’re doing exactly what took you to President’s Club last year, but it no longer works. The same follow-ups. The same sequences. The same conversations. The difference is that deals don’t move, and you can’t point to a single reason why.

That is the part sales culture rarely talks about. Sales slumps aren’t a phase. They’re a delayed consequence of how you built your pipeline weeks ago.

However, there are proven ways to address it. And no, I’m not talking about being placed on a performance improvement plan and having your every move monitored, only to be eventually fired.

If you are in a sales slump, the first thing to acknowledge is that you are not alone. This is not a unique experience. But that’s a good thing! Almost every experienced seller has seen this phase. What matters is knowing how to hit reset before it drags you down.

What is a Sales Slump?

A sales slump is a sustained period where deals lose momentum and decisions slow down.

It doesn’t always mean activity has dropped. In many cases, on the contrary, it appears steady. Work still gets done, meetings still happen, follow-ups still go out, but the impact weakens. Conversations lose edge. Outreach blends in.

Deals advance in name, not in substance.

In other situations, the slowdown comes from the buyer side. Decisions stall for reasons unknown, risk isn’t fully surfaced, or internal alignment never solidifies. Effort continues, but forward motion doesn’t.

What separates a sales slump from a bad month is repetition. A bad month has a clear cause. A slump shows the same patterns across multiple deals: stalled mid-funnel movement, late objections, soft commitments, or progress that looks real until it isn’t.

Sales slumps don’t point to a single failure. They signal that the system producing results has lost precision.

Josh Braun, an eminent sales coach, has an interesting approach to changing your mindset when you’re in a slump.

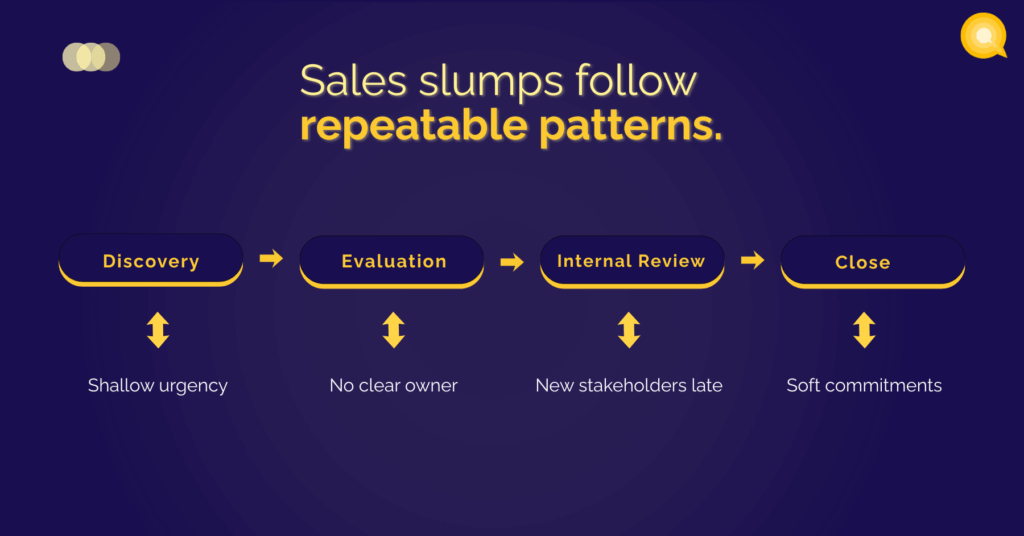

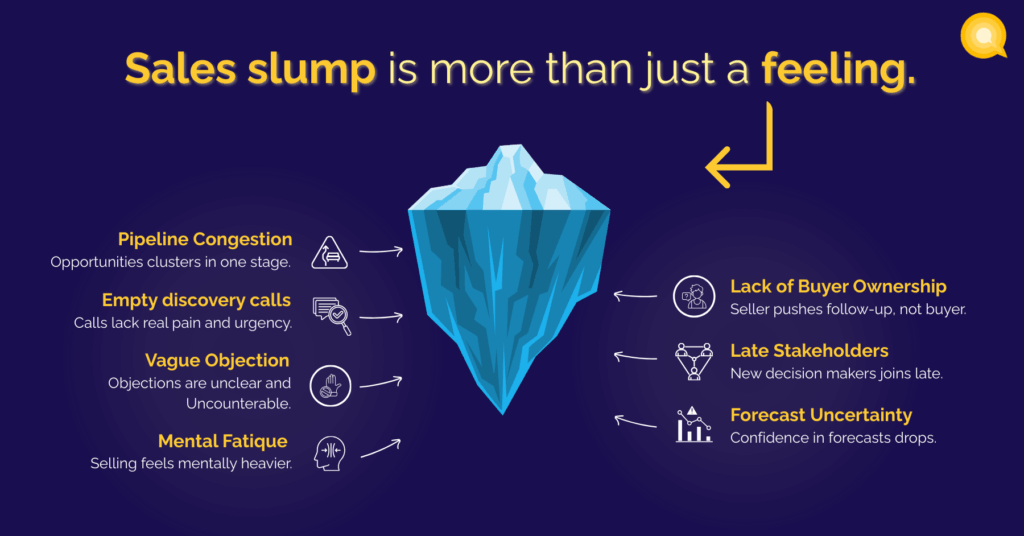

How does a sales slump actually show up in your pipeline?

A sales slump shows up as specific, repeatable patterns across your pipeline. If you look closely, the signs are concrete:

Deals stall at the same stage: Opportunities cluster in evaluation or internal review. Buyers agree the solution makes sense but avoid committing to timelines or next steps.

Next steps become seller-driven: You’re the one pushing follow-ups and suggesting meetings. Buyers stop co-owning the process.

Discovery stops producing new information: Conversations sound positive but shallow. You hear surface-level problems, not personal stakes or urgency.

Late-stage surprises increase: New stakeholders appear late. Objections surface after weeks of progress. Procurement or legal raises issues that should have come up earlier.

Forecast confidence drops: You still commit numbers, but you hedge mentally. You’re not surprised when deals slip, but you dread the review calls with your manager every week.

Execution starts slipping due to procrastination: Tasks that usually happen immediately begin to slide. Proposals get delayed, follow-ups wait another day, and the next steps feel less urgent, even on deals that matter. The longer things sit, the easier it becomes to justify waiting, and stalled momentum starts reinforcing itself.

How to catch a sales slump before it turns into a PIP

Most reps don’t get put on PIPs because of one bad month. They get there because warning signs went unaddressed.

At this stage, the risk isn’t just missing quota. It’s losing credibility in forecast calls before you realize it’s happening. And once credibility slips, every future commit gets questioned, even when you’re right.

Early warning signs include:

- Over-reliance on a small number of large deals

- Mid-funnel stagnation across multiple opportunities

- Fewer net-new deals entering the pipeline

- Hesitation to qualify out late-stage deals

- Forecasts padded with “soft commits”

Prevention isn’t about panic activity. It’s about pipeline hygiene, earlier qualification, and honestly analysing buyer signals.

P.S.: Even top sellers hit sales slumps

One of the most damaging myths in sales is that slumps only happen to people who are bad at their jobs. In fact, I fell for this propaganda too.

But my perspective shifted as I spoke to our resident AE, Mayank Deepchandani.

On paper, his career reads like a highlight reel with big names like Google and Adobe. Not to mention, a move into fast-growing SaaS in a zero-to-one environment that most sellers never experience. By any reasonable measure, this is someone who knows how to sell.

And yet, he hit a slump right after one of his biggest wins.

“I did 203% in one quarter. And whenever you go really big, the quarter after that is usually either average or worse, unless you’ve planned for it.”

In the next quarter, his number dipped to 67%.

The warning signs were there, but the impact showed up later.

“You usually don’t see a pipeline slump very late. You can sense it in the initial days itself. Even in the days when you’re closing and winning, that’s when you need to be careful.”

When asked why this happened, his answer was blunt. “The mistake is being too happy on the good days. Those good days are often the ending of a heavy pipeline.”

This is the part most sales stories leave out. Strong quarters can quietly set up weak ones, and by the time numbers reflect the problem, the damage is already done.

Sales history is full of leaders who have lived some version of this. Top performers who rode a hot streak too long or senior sellers who carried soft commits into forecast calls.

Mayank suggests planning in advance instead of regretting later. “The best sellers plan their pipeline annually, not quarter by quarter. If you don’t zoom out, the slump is already in motion.”

Aluede Damilola Moses, BD at Procedureflow and ex-founder at Revwit, shared his advice on getting out of a funk, likening the experience to that of a sportsperson.

He believes that aside from getting back to the basics and improving execution, you must also stop and celebrate the small wins along the way to realise that you chose this career for a reason and that despite hitting a few small bumps, you still love your job.

If you’re staring at a rough stretch right now, this isn’t a verdict on your ability. It’s a reminder that sales careers are inherently uneven, and even the most experienced sellers can be caught by the same patterns.

The difference is not whether a slump happens. It’s whether you recognize it early enough to do something about it.

The fastest way out of a sales slump

Stop tying your confidence to outcomes

When sellers fixate on quota, you end up relying on guesswork and qualifying every lead into your funnel “just in case”. We recommend focusing on quality over quantity, and ensuring you close accounts who are enthused about your product instead of scratching your head over a few maybes.

“Output is not the parameter you should look at. Input is. If your inputs are right, you don’t go to zero.” — Mayank Deepchandani, Account Executive at Humantic AI

What this means in practice:

- Prep every call with two buyer-specific questions, not a generic agenda

- Leave calls with buyer-owned next steps, or you treat it as a signal

- Qualify earlier instead of carrying hope forward

Show up every day with discipline, not desperation

Most sellers react to slumps by oscillating between overactivity and burnout, which obviously isn’t the way to go.

Discipline means showing up consistently, even when confidence dips, and executing fundamentals cleanly instead of emotionally.

What this means in practice:

- Same prep standards on slow weeks as strong ones

- Fewer reactive follow-ups, more intentional multi-threading

- No sudden process overhauls mid-quarter

Decenter yourself

While it’s terrible that you’re going through a sales slump, dwelling on it will only worsen it. Instead take a step back and with every sales call, every email, etc focus on the other person whose career depends on this sale. The buyer. The person and the company.

This empathy can be the core differentiator.

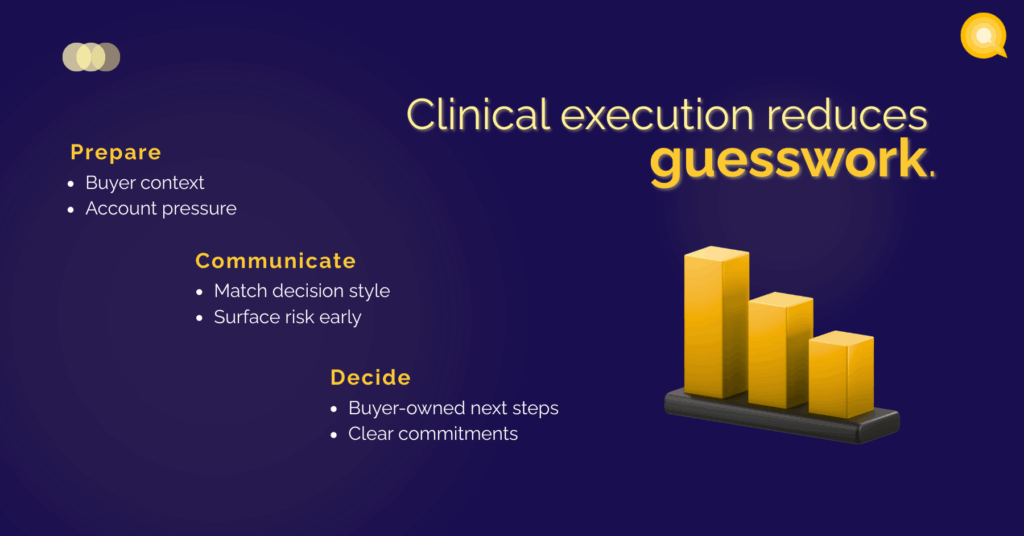

Build systems that support clinical execution

“Sales is not point A to point B. It’s point A to Z to C and then back to B. What matters is how well you execute each step.” — Mayank Deepchandani, Account Executive at Humantic AI

Clinical execution here means:

- Outdo your past self by investing in coaching

- Employing tools (AI or otherwise) that make you more effective

- Knowing the buyer’s business and pressures

- Adapting communication to buyer personalities

We recommend connecting with sales coaches on LinkedIn to get you out of your slump. Here are some examples:

– Mor Assouline for improving demo to closure rates

– Josh Braun for cold email outreach

– Jacco van der Kooij for overall sales process optimization

Alternatively, it’s worth considering if what took you to Club last year will continue to be the reason you make it this year. Or is it time to embrace AI that helps you stand out with authenticity, relevance, and personalization at every stage of your deal cycle. Humantic’s AI agents arm you with copious insight into the companies you’re selling into and the people that are responsible for the buying decision.

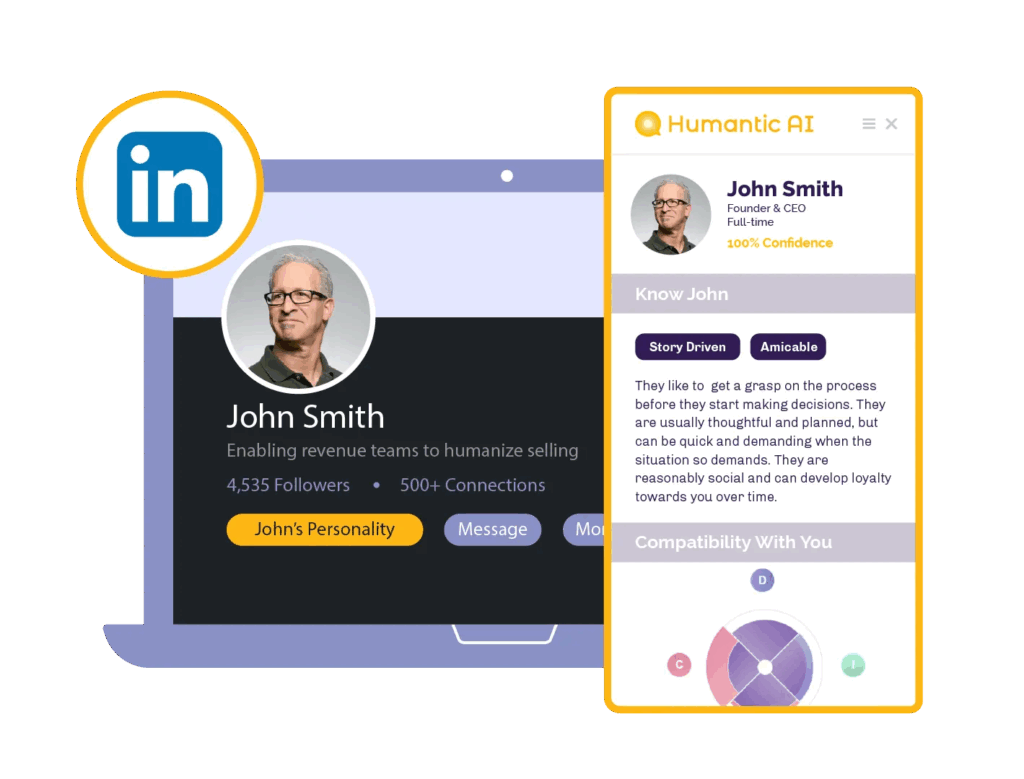

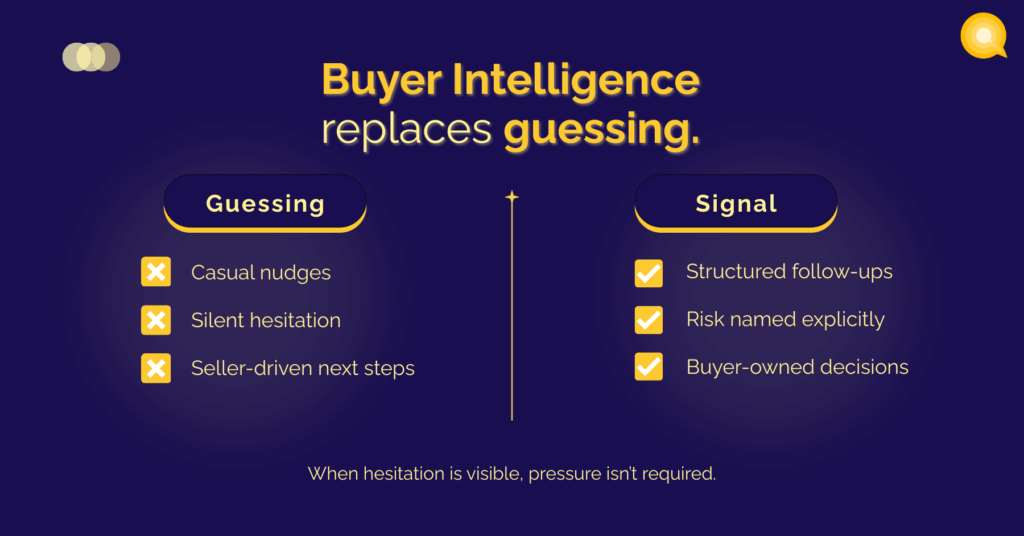

This helps decenter yourself and your sales slump, and focus instead on your buyer and solving their problem in the best possible way. Instead of guessing, sellers can see how different stakeholders prefer to communicate, how they evaluate risk, and where hesitation is likely to show up.

Let’s explain this with an example:

It’s the end of the quarter and Michael needs one last deal to close to hit quota. He finds that a late-stage deal has stalled after legal review. Instead of panicking or pushing harder, he uses Humantic.

Michael opens the account and checks PI (Personality Intelligence) for the primary stakeholder: John Smith. The profile shows a detail-oriented and amicable personality.

He adjusts his follow-up accordingly:

- Sends a structured email while maintaining a friendly tone

- Lists remaining risks and addresses their potential doubts

- Asks which specific risk is blocking sign-off

Before the next call, Michael reviews MIIA (Meeting Intelligence AI) from the previous conversation. He notices that John was confused regarding the legal timelines but didn’t outright mention it.

He addresses that concern directly in the follow-up. The buyer responds with clarity, not silence.

That’s how sellers regain signal during a slump: by replacing assumptions with buyer intelligence and executing with clarity instead of pressure.

Battle sales slumps like a pro

Sales slumps are part of long sales careers. Even elite sellers hit them.

But the elite ones tighten systems before they reach a point of no return. They fall back on discipline and preparation, not pressure.

If you’re in a slump right now, you’re not broken. You’re getting feedback. And with the right structure, it doesn’t have to last long.

If you want fewer guesses, clearer buyer signals, and a more repeatable way to execute when deals slow down, tools like Humantic are built for exactly this moment.

Try Humantic today and give yourself an edge where it actually matters: understanding buyers and their problems better than anyone else. That’s the real competitive advantage, and no slump can defeat true buyer-first principles.

FAQs

What causes a sales slump?

A sales slump is caused by weak buyer signal entering the pipeline weeks earlier. Deals advance without clear ownership, urgency, or internal alignment. As these fragile deals accumulate, momentum slows mid-funnel and sellers are forced to push progress instead of buyers pulling it forward. The root cause is loss of qualification and discovery precision, not lack of activity.

How can you tell the difference between a bad month and a sales slump?

A bad month is driven by a specific, identifiable factor and usually self-corrects. A sales slump shows repeated patterns across multiple deals, such as stalled mid-funnel movement, late objections, and reliance on soft commitments in forecasts. The key difference is repetition and delayed impact rather than a single missed outcome.

What are the earliest warning signs of a sales slump?

The earliest warning signs include mid-funnel deal stagnation, seller-driven next steps, fewer net-new opportunities, and reluctance to qualify out weak deals. Forecast confidence often drops before revenue does. Sellers may also notice subtle execution delays, such as slower follow-ups or conversations that sound positive but lack concrete progress.

Why do sales slumps often appear after strong quarters?

Sales slumps often appear after strong quarters because high performance exhausts an existing pipeline. During winning periods, sellers may relax qualification standards or slow new pipeline creation. When the pipeline empties, the next quarter exposes the gap. The slump begins during the strong quarter, not after it.

What is the fastest way to recover from a sales slump?

The fastest way to recover from a sales slump is to tighten inputs rather than increase activity. This means qualifying earlier, restoring buyer-owned next steps, and rebuilding buyer signal across active deals. Strong sellers focus on disciplined execution and clarity rather than pressure. Tools like Humantic AI help by making buyer behavior, risk tolerance, and communication preferences visible so sellers can act on signal instead of assumptions.