Introduction: Why Sales Metrics Need a Reset in 2025

In the early 2020s, sales teams focused on activity metrics like calls and emails. But today, those numbers no longer predict success. Buyers want relevance, and pipelines stall despite high activity.

If your team feels stuck, you’re not alone. Leading sales organizations now measure outcomes, not just activity, and the results speak for themselves.

This playbook reveals 8 KPIs that drive real growth and a 90-day plan to get you there.

The Vanity Metric Crisis

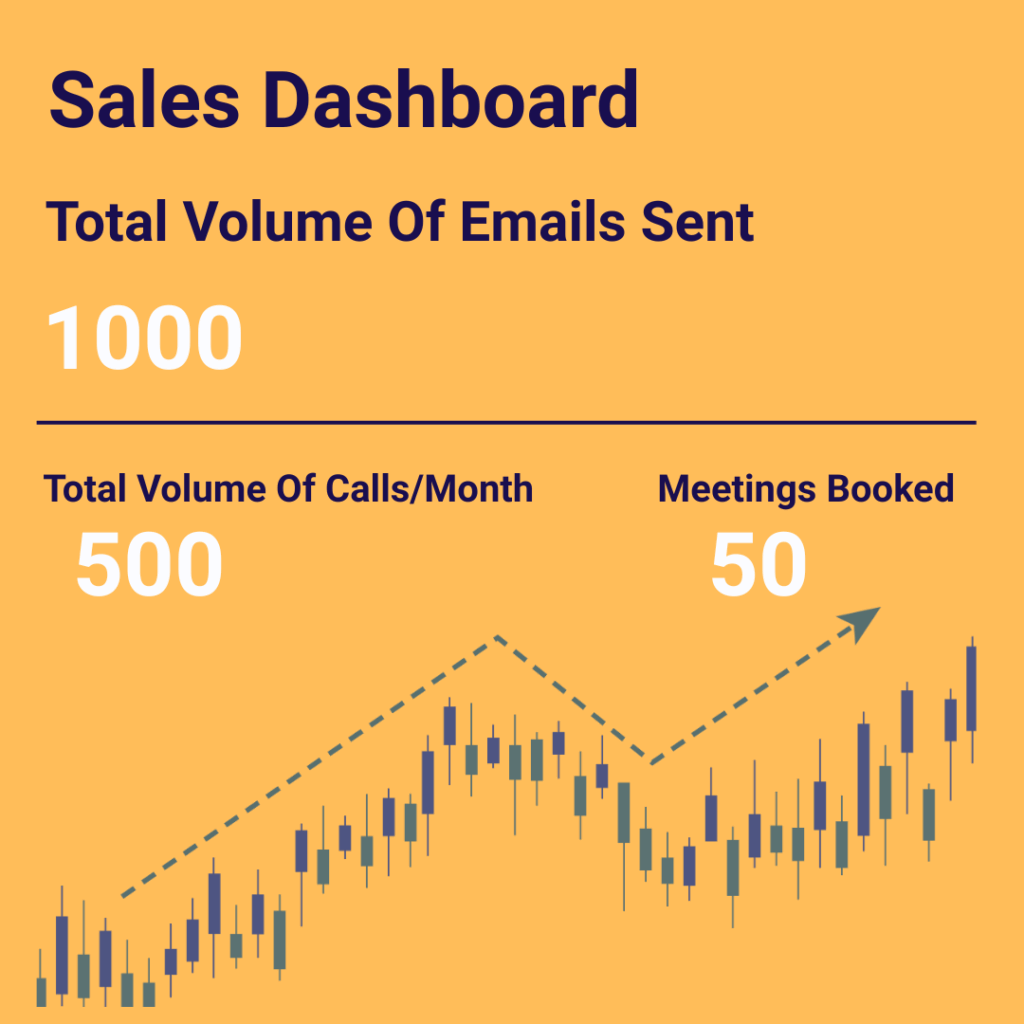

Your dashboards look impressive:

- 500 calls/month

- 1,000 emails sent

- 50 meetings booked

But your pipeline grows just 3% quarter-over-quarter.

It’s a problem many teams face in 2025: you’re tracking movement, not momentum.

Why Legacy Metrics Fail

Traditional sales metrics emphasize quantity over quality:

- 72% of buyers ignore generic outreach (Salesforce)

- Activity-based comp plans drive 43% more spam complaints (Gartner)

- Top sellers now spend 68% more time per account (Forrester)

High activity does not equal high conversion. Buyers don’t reward volume, they reward relevance.

The Outcome-Based Framework

Here’s how enterprise teams are redefining sales efficiency through 8 new KPIs:

1. Alignment Redefined

“Alignment” isn’t about marketing and sales being friendly. It’s about shared ownership of pipeline progress.

- Marketing provides researched, high-fit leads

- Sales tracks engagement across buying committees

- Customer Success flags expansion signals early

New KPI: Stakeholder Coverage Score – % of known decision-makers engaged per account

2. The “Less is More” Mandate

Fewer, deeper plays beat more, shallower ones:

- Target 40% fewer accounts

- Spend 2.5x more time per target

Impact:

- 18% higher win rates

- 35% faster deal cycles (McKinsey)

New Habit: Cap each rep at 50 outbound accounts. Require 3+ hours of research per account before outreach.

3. The KPI Revolution

Time to replace outdated metrics:

| Legacy Metric | New KPI | How to Measure |

| Calls made | Message Relevance Score | AI analysis of tone & context |

| Emails sent | Buyer Response Index | (Replies + Meetings) / Outreach |

| Meetings held | Decision-Maker Attendance | % of meetings with authority |

Case Study: DOMO adopted these metrics and saw a 30% lift in win rate by focusing on outcome KPIs over volume.

4. Measuring Personalization at Scale

Personalization is now a leading indicator of pipeline velocity.

New KPIs:

- Personalization Score (content relevance to persona + org)

- Time Spent Researching (via LinkedIn views, CRM tracking tools)

- Intent Match Rate (based on AI signals from tools like Humantic)

Why it matters:

Buyers can spot templated outreach. Teams using personality and firmographic data close 2.1x more deals.

5. Sales AI as Infrastructure

AI isn’t a layer, it’s your operating system. Use Sales AI to:

- Prioritize high-fit accounts

- Craft buyer-aligned messages

- Automate follow-ups

- Coach based on real buyer behavior

Example: Humantic AI surfaces DISC/OCEAN insights + motivation markers, helping teams adapt messaging tone, timing, and CTAs to individual buyer psychology.

Result:

6. Quantifying the Human Element

Sales remain human. But now, we can measure humanity.

Track:

- Buyer Sentiment Trends (via call analysis tools)

- Follow-Up Timeliness

- Buyer Experience Ratings (post-meeting surveys or NPS)

Why: Buyers are 3x more likely to convert when they feel understood.

7. Opportunity Cost & Conversion Efficiency

Don’t just track quota attainment, track what it costs you.

Metrics to adopt:

- Deal Conversion Efficiency (Deals Closed / Pipeline Created)

- Research Time ROI (Deals Influenced per Hour of Research)

A bloated pipeline that rarely converts is just expensive noise.

8. Outcome-Focused Execution

Vanity metrics create false signals. Instead, track:

- Stakeholder Engagement Velocity

- Time-to-Value post-close

- AI-Assisted Close Rates

McKinsey reports that early adopters of sales automation consistently see:

- Efficiency improvements of 10 to 15 percent,

- Sales uplift potential of up to 10 percent,

- And companies that automate non-selling activities free up to 20–25% more sales rep capacity, enabling reps to spend more time with customers and drive better results.

Additionally, go-to-market transformations can yield revenue gains of up to 20%, while customer experience improvements typically deliver 5–10% growth.

These gains underscore the value of focusing on KPIs that reflect buyer experience and intent, rather than just seller output.

Final Word: Better Sales Look Like This

The best teams in 2025 aren’t just sending more messages. They’re:

- Deeply researching before outreach

- Aligning with how buyers think, act, and decide

- Letting outcome KPIs guide where and how they sell

And when AI enables that?

- 6x transaction rates (Salesforce)

- 30–50% faster deal cycles

- Higher loyalty, lower churn

The future of sales is precision-driven, buyer-aligned, and outcome-measured. And it’s already here.

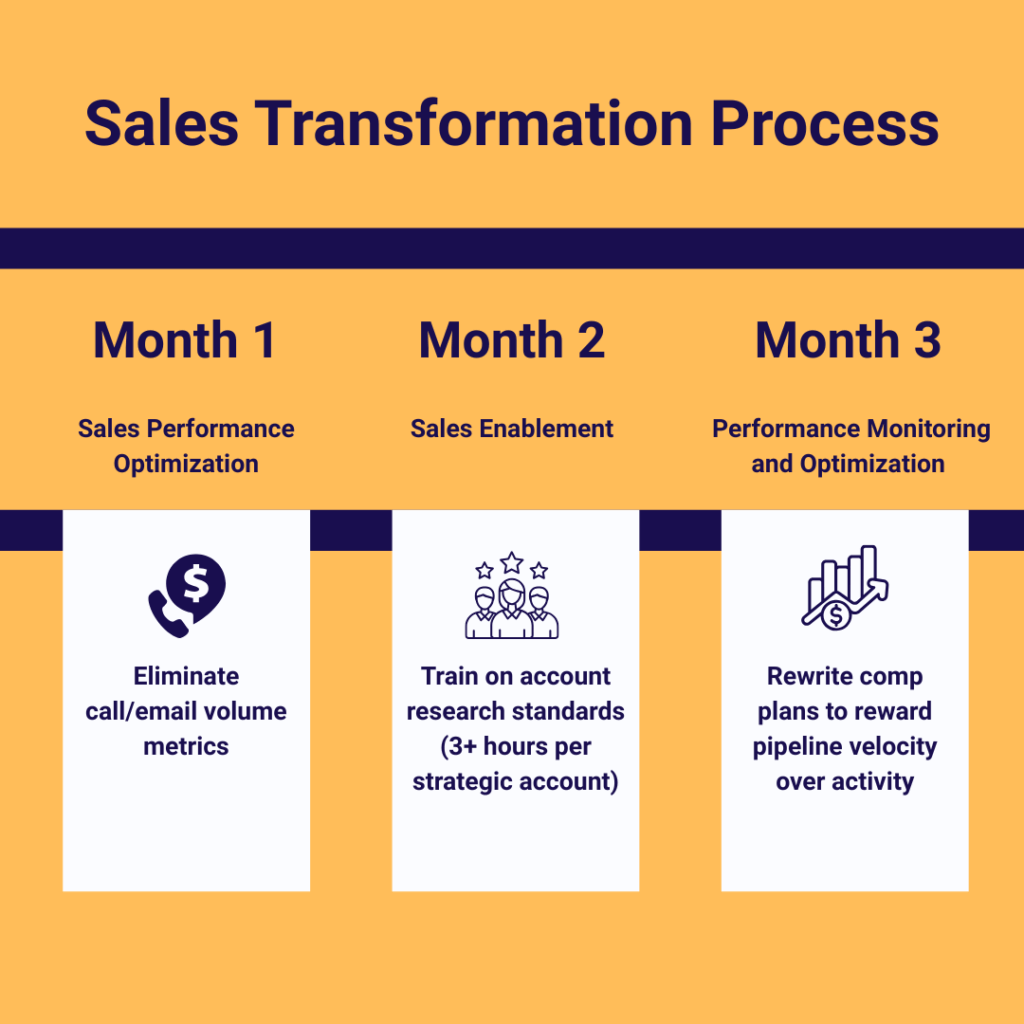

A Proven Framework for Outcome-Driven Sales Transformation

This 90-day plan follows a simple “Measure, Learn, Optimize” approach: first, replace vanity metrics with meaningful KPIs; next, build skills to deepen account insights and track buyer sentiment; finally, align incentives and analyze results to continuously improve. This phased process ensures lasting change and measurable impact.

| Month 1 | Month 2 | Month 3 |

| Eliminate call/email volume metrics | Train on account research standards (3+ hours per strategic account) | Rewrite comp plans to reward pipeline velocity over activity |

| Pilot 2 outcome KPIs (Start with Stakeholder Coverage + Message Relevance) | Implement buyer sentiment tracking | Conduct a win/loss analysis focused on buyer experience |